ACA, PENALTIES, AND NEXT STEPS

Recently, Medcom, EAF’s endorsed benefits administration provider, updated members on next steps now that employers have finished their first required completion and submission of the 1094 and 1095 forms and are now grappling with the first round of penalties that have been issued by the Internal Revenue Service (IRS).

1094 & 1095s

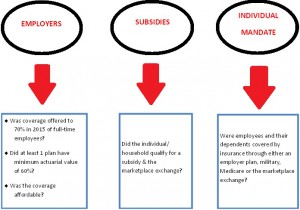

During the program, Medcom explained that the IRS was looking for:

2016 Changes

- The Affordable Care Act (ACA) requires employers to offer minimal essential coverage (MEC) that meets minimum value to at least 95% of full-time/full-time equivalent employees.

- Loss of transitional relief for employers with 50-99 full-time or full-time equivalent employees

- Must offer coverage to dependents

- Increase in penalties:

- Shared Responsibility Test 1 (Employer required to offer minimum essential coverage and minimum value to 95% of employees): Penalties increase from $2,000 to $2,160

- Shared Responsibility Test 2 (Tied to minimum value and affordability): Penalties increase from $3,000 to $3,240.

- “Good Faith” isn’t enough. Employers must now meet a higher bar of reporting proper codes on ALL 1095-C forms in 2016

- May be able to argue “reasonable cause” but the standard is very high and time consuming as well as time sensitive.

- 1095-C Forms:

- 1095-C forms must be postmarked by 1/31/17

- Employees will need 1095-C forms to complete individual tax returns

ACA Statistics

- As of 2/1/16, 12.7 million people selected coverage through the Marketplace.

- Marketplace enrollment is expected to increase to 15 million enrollees in 2017.

- The Congressional Budget Office (CBO) expects subsidies for individuals under age 65 to total more than $600 billion

These statistics are important because the CBO expects individual penalties on individuals who fail to purchase insurance to amount to $3 billion in 2016 and up to $38 billion in 2017-2026. But more importantly to your business, the CBO expects employer penalties to total $228 billion in 2017-2026.

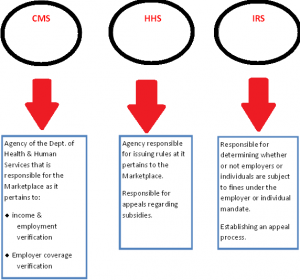

SUBSIDY APPEALS

On June 21, 2016, the Centers for Medicare & Medicaid Services (CMS) issued 550,000 notification letters for subsidies given in 2016 and will continue to be issued in groups on a regular basis. These notices show you the subsidies that have been given in 2016. It’s important that employers pay attention to these notices because they only have one opportunity to appeal and it must be done within 90 days.

Employer Reporting Penalties

IRS Notice 972CG or the ’ “proposed penalty rule” includes:

- Explanation

- How to respond

- A record of each submission on the total penalty

- A summary of the penalty

- Response page

Employers must respond to this notice within 45 days or the full penalty will be assessed. If more time is needed, the request must be in writing.

Employer Shared Responsibility Penalties

Shared responsibility penalty notices for 2015 are expected to be sent at the end of this year. The employer will have an opportunity to challenge the penalties, but it will take time…one to two years.

How EAF and Medcom can help…

Employer Penalty Appeal Support Professional Guidance ERISA Attorneys including:

- Review the subsidy notification letters to determine basis for subsidy decision

- Review the summary of benefits & coverage, premium cost sharing, measurement periods & 1095-C’s, where applicable

- Review the coverage offered and salary information of the individual to determine if coverage was affordable

- Review employment dates of coverage on file

- Prepare an appropriate response to the subsidy notification within 15 DAYS

- Medcom will notify the client within 10 business days if there is no appropriate appeal to the subsidy and indicate whether or not they may be facing a penalty

- Medcom will place the response in the client portal and the client will have an additional 15 DAYS to review

- Medcom will advise the client as to the next steps to mitigate potential penalties

- Medcom will maintain documentation for each review

EAF members receive preferred rates on Medcom services. For more information on ACA requirements and Medcom services, please call or email EAF (407.260.6556 or [email protected]) to learn more.

Interested in EAF Membership? Join now and receive 10% off NEW Member Dues!

Use PROMO CODE: EAFRocks on your Member Application.